If you are 70 1/2 or older and you have an Individual Retirement Account (IRA) you may be required to remove funds by the end of the year. For some, the Required Minimum Distribution (RMD) will increase income tax payments. For some, the extra income will trigger taxes on Social Security benefits.

You need to check with your tax advisor first, but one really great way to limit tax consequences is to transfer a portion to a 501c3 like the Leelanau Conservancy. The term for doing this is called making a Qualified Charitable Distribution (QCD). Funds need to be transferred directly from the IRA to the charity to be eligible.

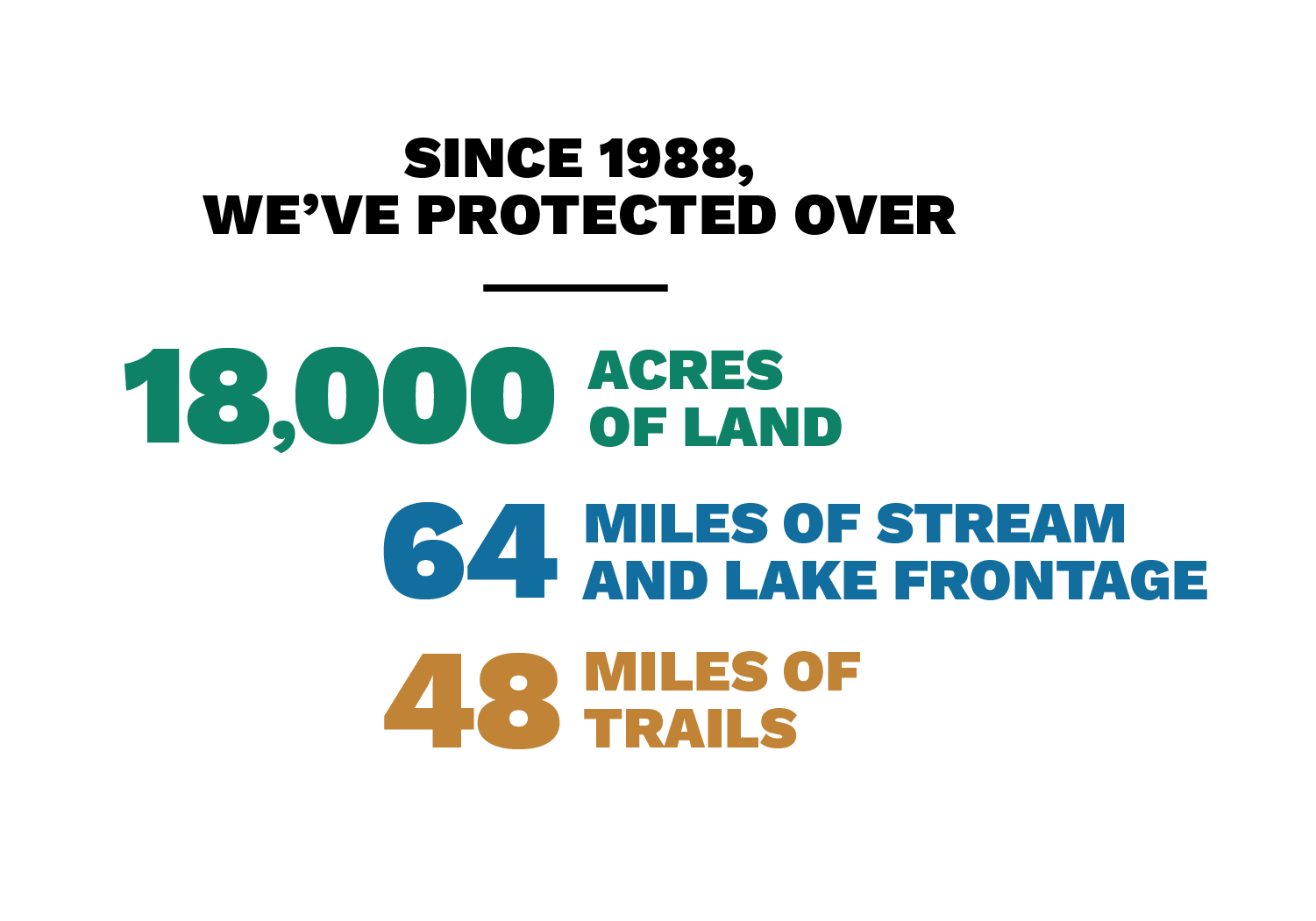

So, if you’re old enough, distributing IRA funds to the Leelanau Conservancy is a win-win. You win by helping the Leelanau Conservancy protect the land, water and scenic character of the county for future generations; and you may also win by having a lower tax bill.

First be in touch with your tax advisor, and then be in touch with Emma Stoppani, Major Gifts Officer, at estoppani@leelanauconservancy.org or 231-256-9665. IRA, RMD, QCD—it may sound like alphabet soup; we would love to help!

Posted Oct. 24, 2016